Real Estate Round Up

July 11, 2023 | Blog

Here is the weekly round up of real estate news.

While transaction activity in the 1st half of 2023 was constrained by high mortgage rates and low inventory, demand remains strong and prices are rising in most markets. What will the 2nd half hold? Mortgage rates should follow inflation lower.

National Real Estate News

Spot the trend?

The blue line is “headline” inflation (PCE). It dropped from 4.3% –> 3.8% in May and has almost HALVED since the middle of 2022. The red line is “core” inflation (PCE excluding food and fuel). It has been much more stubborn, but is clearly heading downward. Despite these obvious positive trends, the market expects the Fed to lift short-term rates by another 25 bps on July 26.

Pending sales fall …

Pending home sales (signed contracts) fell 2.7% month-over-month in May. That’s the 3rd-straight month of decreases. As the Nat’l Assoc. of Realtors’ Chief Economist wrote, “Despite sluggish pending contract signings, the housing market is resilient with approximately three offers for each listing. The lack of housing inventory continues to prevent housing demand from being fully realized.”

… on a lack of inventory

The inventory of homes for sale came roaring back in 2022. But that recovery has stalled with new listings in early 2023 running 20-25% below last year. There were approximately 614,000 units of active inventory in June 2023, up just 7% year-over-year and just HALF of what it was in June 2019 (pre-COVID) at 1.2 million units. And the inventory shortage in many individual cities is far worse.

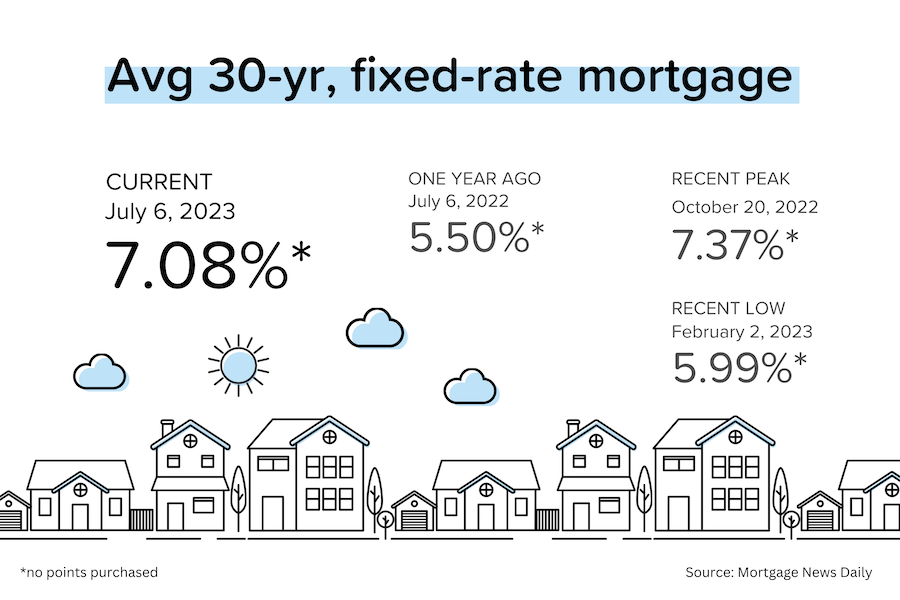

Mortgage Market

The last few weeks have brought a slew of bad news for the mortgage bond market: stubborn “core” inflation, big job gains from ADP, and the upward revision to 1Q 2023 GDP. Remember, when it comes to the bond market, what looks like good news economically is often bad news for bonds because it increases the risk of ‘higher for longer’ interest rates.

The next Fed meeting is on July 26. Based on Fed fund

s rate futures contracts, the market is currently pricing in a 95% chance of a +25 bps hike. 95%!!! In other words, that the June decision to keep rates on hold was indeed a ‘skip’ rather than a ‘stop’.